In a market where traditional solutions are complex and resource-intensive, OptionX delivers a streamlined, efficient hedging solution designed for ease of use. Leveraging technology from the alpha/betting industry, our approach solves the hedging challenge with an innovative process that minimizes client resource demands.

This empowers clients to make informed, data-backed decisions with a clear understanding of dynamic market environments.

OptionX goes beyond standard FX rates and implied volatility, simulating real-world outcomes for specific hedge expiries with high fidelity. Key advantages include:

OptionX delivers insights that help clients understand the true cost-benefit balance of their hedging strategies:

This enables clients to build strategies with mathematically optimized, risk-adjusted value.

The OptionX backtest engine provides clients with a clear view of their past bottom line under alternate OptionX-powered hedging regimes.

OptionX back tests are easy to customize using parameters at helicopter-view level.

OptionX goes beyond standard FX rates and implied volatility, simulating real-world outcomes for specific hedge expiries with precision. Key advantages include:

OptionX delivers insights that help clients understand the true cost-benefit balance of their hedging strategies:

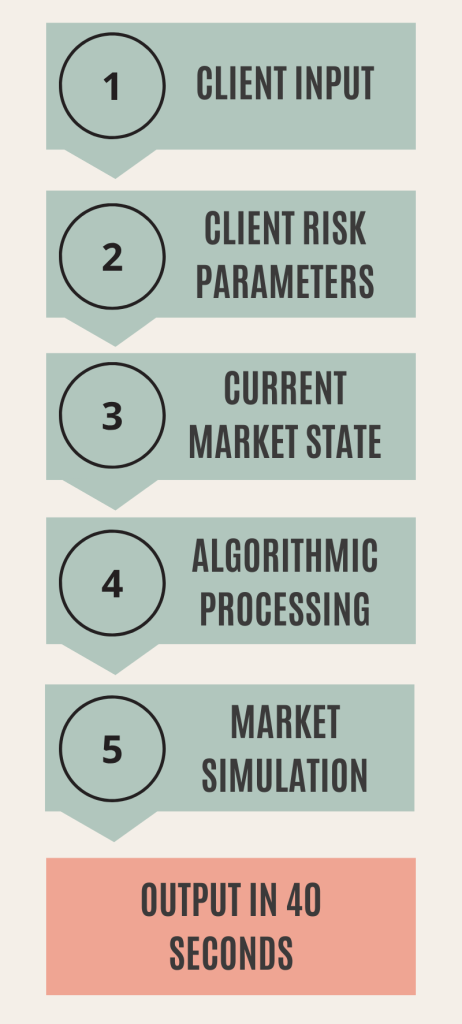

OptionX employs a powerful 5-step computational process for hedge optimization, designed to transform client input and risk parameters into actionable insights.

In just 40 seconds, OptionX leverages current market data, algorithmic processing, and extensive simulations to deliver a precise, quantified analysis. This rapid, sophisticated approach supports informed and strategic decision-making.

✓ Real-time overlay and ranking of structures

✓ Adaptive Hedge Ratio

✓ Expected effective rate

✓ Optimal hedge decision

Customized Currency Stress Tests: Choose trend currencies via dropdown to test performance against home or selected currencies

Projected Portfolio Outcomes Under Market Shocks

Our Portfolio Tracker provides tools unmatched by other providers, giving clients an integrated, real-time view to maintain policy compliance.