Know Your Position

The industry’s most advanced hedging analytics, quantifying and clarifying every aspect of your currency and risk positions.

Adapt Instantly

Real-time portfolio adjustments on demand—respond to volatility bursts and major market changes without delay.

Alternative Scenario Insights

Comprehensive “what-if” scenario analysis, with clear metrics on the cost and benefit of alternative hedging strategies.

Total Risk Transparency Multi-dimensional risk metrics: from Value-at-Risk to worst-case cash flows, keeping you informed on real-time portfolio exposure. Real-World Uncertainty, Quantified Understand the impact of each decision under realistic scenarios, backed by advanced math for optimal risk-adjusted outcomes.

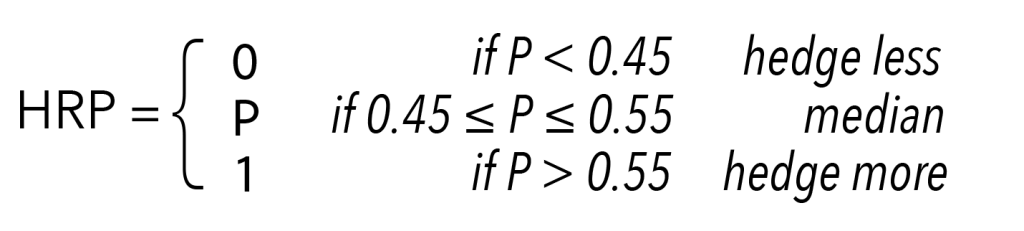

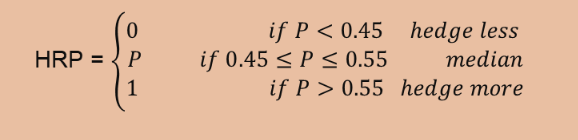

Linear Hedging with Hedge Ratio Percentage (HRP)

Our rule-based HRP formula minimizes volatility while optimizing hedging rates over time for both income and expenses. The HRP quantifies the ideal hedge level, helping you decide how much to hedge and when costs might outweigh benefits. This approach applies across static, rolling, or layered hedging strategies, delivering clear benefits and reducing time spent on hedging decisions.

Non-Linear Hedging with Forward Market Bias (FMB)

For non-linear structures, the forward market bias (FMB) represents the minimum percentage of times a forward position must yield a gain at expiry to outperform our non-linear strategy. We only consider structures with FMB≥50%, ensuring a statistically positive return. As FMB increases, the added basis points also increase, but the number of eligible hedges decreases, highlighting our strategic edge over forwards and the ability to price hedging risk correctly.

Data Security Without IT Integration

Our technology is fully secure, requiring no IT integration and storing all data locally, ensuring privacy and control. Clients can operate the system independently, and all backtesting can be performed on-site—meaning we never see trade details or sensitive data. With flexible options for data upload and NDA provisions, clients can be up and running on the same day without any security concerns.

Performance-Based Control

We empower clients with a unique results-driven model: no fees unless our solution meets or exceeds the client’s benchmark. This level of control allows clients to define the performance criteria, holding us accountable to measurable outcomes – something unprecedented in the treasury and hedging space.

The industry’s most advanced hedging analytics, quantifying and clarifying every aspect of your currency and risk positions.

Real-time portfolio adjustments on demand—respond to volatility bursts and major market changes without delay.

Comprehensive “what-if” scenario analysis, with clear metrics on the cost and benefit of alternative hedging strategies.

Multi-dimensional risk metrics: from Value-at-Risk to worst-case cash flows, keeping you informed on real-time portfolio exposure.

Our rule-based HRP formula minimizes volatility while optimizing hedging rates over time for both income and expenses. The HRP quantifies the ideal hedge level, helping you decide how much to hedge and when costs might outweigh benefits. This approach applies across static, rolling, or layered hedging strategies, delivering clear benefits and reducing time spent on hedging decisions.

For non-linear structures, the forward market bias (FMB) represents the minimum percentage of times a forward position must yield a gain at expiry to outperform our non-linear strategy. We only consider structures with FMB≥50%, ensuring a statistically positive return. As FMB increases, the added basis points also increase, but the number of eligible hedges decreases, highlighting our strategic edge over forwards and the ability to price hedging risk correctly.

Our technology is fully secure, requiring no IT integration and storing all data locally, ensuring privacy and control. Clients can operate the system independently, and all backtesting can be performed on-site—meaning we never see trade details or sensitive data. With flexible options for data upload and NDA provisions, clients can be up and running on the same day without any security concerns.

We empower clients with a unique results-driven model: no fees unless our solution meets or exceeds the client’s benchmark. This level of control allows clients to define the performance criteria, holding us accountable to measurable outcomes – something unprecedented in the treasury and hedging space.